Unveiling the Potential: Open Banking in Developing Countries - A Regression Analysis

Table of Contents

1-INTRODUCTION _____________________________________________________1

2-LITRETURE REVIEW_________________________________________________7

3-DATA AND METHODOLOGY__________________________________________8

4-PROPOSED CHAPTERS_______________________________________________11

5-RESEARCH TIMETABLE______________________________________________12

REFERENCE_________________________________________________________13

- INTRODUCTION

1.1 Open Banking

In the modern era, data has become the most valuable asset in various financial sectors. In 2016, a report by the Competition and Market Authority unveiled the dominance of established banks, which faced little competition, while newer and smaller banks struggled to gain a foothold (Competition and Market Authority, 2016). This lack of competition left customers with limited choices and control over their financial information. Open Banking, a revolutionary business model, has emerged to transform online banking by challenging traditional assumptions, including the issue of asymmetric information, and creating new opportunities for commercial banking services and the accessibility of financial products.

Open Banking is rooted in the fundamental principle of enhancing data access. It empowers customers and small businesses by allowing them to share their transaction data with third-party providers (TPPs) (Aitamurto & Lewis, 2013). This, in turn, provides individual customers and small to medium-sized enterprises with an enhanced experience in various financial aspects, such as saving, borrowing, and online payments.

At the core of Open Banking lies the use of Open Application Programming Interfaces (Open APIs) (Funk and Hirschman, 2014; Scott and Bolotin, 2016). These APIs enable organizations to harness their valuable data to develop new services and functionalities. Simultaneously, they promote innovative forms of distribution and enhanced servicing capabilities.

Open Banking signifies a transformative shift in the finance industry. It addresses the limitations of competition and customer choice that traditional banking faces. By democratizing access to financial data and fostering innovation through Open APIs, Open Banking empowers customers and small businesses to make more informed financial decisions. This concept not only benefits individuals and small enterprises but also ushers in a new era of possibilities for the entire financial industry.

1.2 How Open Banking Works and Application Programming Interface (APIs)

Open Banking operates by allowing individuals to grant a regulated third-party provider secure access to their bank transaction history. This sharing of financial data is facilitated through a vital technological component known as Application Programming Interfaces (APIs). In simple terms, an API serves as “a means for two computer applications to communicate over a network using a common language that both comprehend” (Jacobson et al., 2012). APIs provide a secure conduit for data transmission to the intended destination, and organizations often employ them to maintain connectivity between various departments and facilitate the exchange of necessary data. Likewise, APIs can be utilized to transfer customer information beyond a financial institution’s boundaries. Central to the concept of open banking is the exchange of customer transaction data through APIs between financial institutions and third-party entities (Nicholls, 2019).

To illustrate how open banking can revolutionize the management of personal finances, consider the scenario where an individual wishes to monitor multiple bank accounts and obtain a comprehensive overview of their financial holdings. In this case, the individual selects a government-regulated money management app that leverages open banking. The app, with the individual’s consent, securely accesses their account details via an API. Upon obtaining permission, the app redirects the user to their bank’s website for online account access. It’s crucial to note that the user’s login credentials remain private and inaccessible to the money management app. Subsequently, the bank requests explicit permission from the user to share their financial data with the third-party app. Once authorization is granted, the money management app can analyze the user’s financial status, provide spending advice, and identify cost-saving opportunities in future expenditures. With open banking, there’s no need for users to disclose their online banking login details, and all third-party providers are subject to government regulations, ensuring data security and privacy (Jacobson et al., 2012; Nicholls, 2019).

1.3 Theoretical Evidence

The initial experiment in open banking took place nearly 40 years ago when the Deutsche Bundepost (German Federal Post Office) conducted a trial run with a limited number of participants using an older form of open banking known as screen text. However, it wasn’t until recent years that open banking gained significant momentum. Governments and fintech companies have undertaken numerous initiatives in the past couple of years to conduct extensive research on open banking. In their study, Zachardias & Ozcen (2017) emphasized that the opening of bank APIs and the sharing of customer data present an opportunity for the implementation of a new business model within the banking sector, with its impact being realized over time.

Open banking is still a relatively new trend in the financial world, and consequently, not all countries have adopted this system. As a result, experts in the field of finance have been actively investigating how open banking will reshape modern banking practices. This exploration has raised several questions, including how traditional financial institutions perceive open banking and how they will adapt to this novel data-sharing platform. A study conducted by Lackberg & Larson (2020) suggested that established banks have been hesitant to abandon their traditional business models due to concerns about profitability, leading to a cautious embrace of the changes introduced by open banking.

Another critical issue arising from open banking is the concept of sharing one’s bank transaction data with third parties, which raises concerns among individuals. This has spurred extensive research in the field, with experts focusing on proposing secure data-sharing mechanisms. For example, research conducted by Kellezi & Boegelund (2019) proposes the establishment of a single government-regulated API that connects all banks and third-party entities, ensuring the secure flow of information to safeguard public data.

Open banking’s evolution has a historical context dating back several decades, but its full potential has only recently begun to emerge as a result of ongoing research and experimentation (Zachardias & Ozcen, 2017). Traditional banks’ responses to this new paradigm vary, with concerns about profitability playing a pivotal role (Lackberg & Larson, 2020). Addressing data security concerns, researchers propose innovative solutions like a government-regulated API to ensure the safety of shared financial information (Kellezi & Boegelund, 2019).

1.4 Research Gap

At present, it’s evident that open banking is a concept with a bright and enduring future, firmly establishing its presence in the financial landscape. Notably, extensive research and initiatives have been undertaken in developed countries, demonstrating the tangible benefits of open banking in helping individuals manage their finances more efficiently and discover improved services. However, it’s important to recognize that such advancements have predominantly occurred in the western world. What remains conspicuously absent from the discourse is a comprehensive understanding of how open banking will impact developing countries and the banking systems within them. Given that open banking is still a relatively recent trend in finance, there is a notable dearth of extensive research on this topic, leaving a crucial area of exploration largely unaddressed.

1.5 Aim of The Study

As previously highlighted, there exists a noticeable research gap concerning the potential implications of open banking for developing countries, particularly in regions where financial literacy and understanding of financial matters may be limited. The core objective of this study is twofold: first, to scrutinize the impact of open banking on developed countries, and second, to assess whether its implementation could yield similar benefits in developing nations. The viability and advantages of open banking for the public are contingent upon several critical factors, including government regulations, levels of financial literacy, the role of Fintech, the involvement of third-party providers, considerations of financial inclusion, the use of Application Programming Interfaces (APIs), and the overall stage of economic development. Consequently, this research endeavors to investigate how these factors have influenced open banking’s performance in developed countries and how these same factors may shape its impact if introduced within the context of developing countries.

1.6 Structure of the Study

In our research proposal, we commenced by providing a comprehensive definition of open banking, expounded on the significance of Application Programming Interfaces (APIs), and elucidated the primary gaps prevalent in the current open banking landscape. Moving to section two, we delved into an exploration of significant research studies conducted in the field of open banking. Section three of our proposal is dedicated to the application of regression analysis as a method for quantifying the performance of open banking in developed countries, scrutinizing its response to external factors. Furthermore, we aim to extrapolate from these findings whether the same analytical framework can be extended to predict the potential performance of open banking in the context of developing countries. In the subsequent section, section four, we propose the titles for individual chapters within the comprehensive study, providing an overview of the structure and content of the forthcoming research. Finally, in section five, we outline a research timetable, offering a well-defined schedule for the study’s progression and key milestones. This timetable will serve as a guide for the effective execution of the research, ensuring its successful completion.

2. LITERATURE REVIEW

Numerous research efforts, both from private and public institutions, have been undertaken to gain insights into the impact of online banking on modern banking practices. In this section, we will highlight some of the key research studies and their respective focal points.

Firstly, Markos Zachardiads and Pinar Ozcan (2017) conducted a study that delved into the fundamentals of application programming interfaces (APIs). Their research not only traced the emergence of this new organizational structure but also made predictions regarding the widespread adoption of public APIs by financial institutions. Furthermore, the study comprehensively outlined the opportunities that open banking brings and the challenges it poses, particularly the implications of open APIs for the banking sector in the United Kingdom and the European Union.

Similarly, another noteworthy research endeavor, led by Gozman, Hedman, and Sylvest (2018), examined the risks and opportunities associated with open banking. They delineated four distinct roles that open banking assumes, namely, producer, platform distributor, and integrator. The research identified potential challenges, including the risk of disintermediation, the potential diminishment of financial institutions’ traditional status, and transformative disappointments. Concurrently, they recognized opportunities such as fostering service innovation and mitigating risk. Overall, this study offered valuable insights into how the retail banking industry is adapting to new innovations and forging partnerships with third-party fintech providers.

Given that open banking is still in its early developmental stages, numerous aspects remain unclear, prompting researchers to investigate it from various perspectives and across different jurisdictions. One such aspect of exploration concerns the impact of open banking on the demand for banking services. In this regard, a study by Lackberg and Larsson (2020) concluded that established banks’ pursuit of a broad customer base and the definition of loyal customers as full-range customers present challenges, as they stand in contrast with the advancements in the retail banking industry. Additionally, the study noted that well-established banks remain somewhat hesitant to fully embrace the transformative changes introduced by open banking.

3. DATA AND METHODOLOGY

3.1 Data Definition and Sources

Since the inception of open banking, researchers in developed countries have diligently amassed a wealth of variables that have a potential impact on the performance of open banking. Our research seeks to explore these variables in order to predict the performance of open banking in developing countries. To achieve this, we must first closely examine how open banking has fared in developed countries and identify the external factors influencing its outcomes. The key variables to be utilized in our study encompass:

Open Banking: recognized as a secure method for sharing financial transaction data with financial service providers to facilitate improved financial decision-making, will be gauged through a survey conducted in the United States. This survey collects the opinions of individuals aged 18 and above to ascertain their perception of the value of open banking (source: www.deloitte.com).

- Developing Countries: Our focus extends to low- and middle-income countries, such as Albania, Brazil, Belarus, Eritrea, India, and Nigeria.

- External Factors: These external determinants can exert either a positive or negative influence on the performance of open banking in both developed and developing countries. The prominent external factors include:

- Financial Literacy: (source: www.oecd-ilibrary.org).

- Regulation: (source: regulations.gov).

- Fintech and Third-Party Providers: (source: fintechdb.com 2020).

- Financial Inclusion: (source: www.worldbank.org).

- Application Programming Interface or APIs: (source: postman.com).

- Economic Development: (source: www.cambridge.org).

By analyzing these variables and their interaction, we aim to gain a comprehensive understanding of open banking’s performance in diverse contexts and its potential impact on the financial landscapes of developing countries.

3.2 Methodology

3.2.1 Research Hypothesis

Drawing upon the data collected and our thorough evaluation, this study puts forth the following research questions:

H1: open banking has had positive feedback and outcomes in developed countries.

H2: open banking will significantly increase the living standard of developing countries

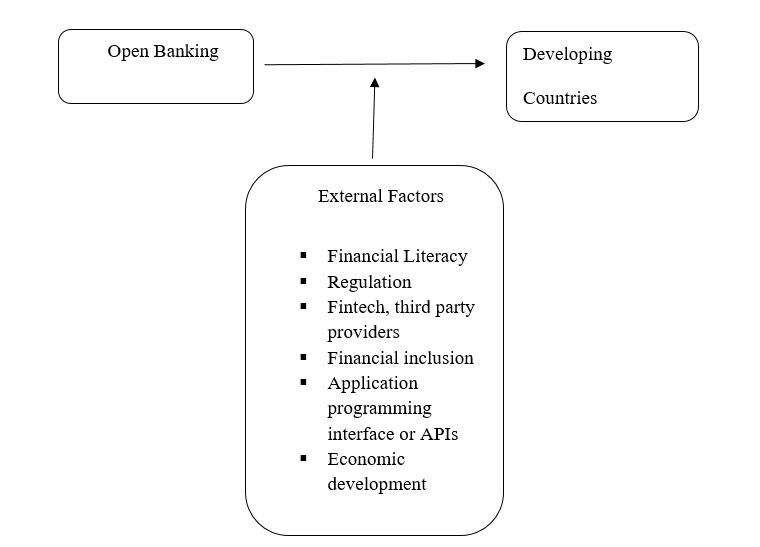

Figure 1 visually illustrates a direct relationship between open banking and the development of countries. However, it is essential to recognize that the performance of open banking is intricately intertwined with the external factors previously mentioned, which play a pivotal role in determining its impact.

`

`

`Figure 1. Conceptual Model of the relationship between open banking and developing countries

3.3 Methodology

To ensure robust and just research, our concept and proposal necessitate rigorous testing through regression model analysis. This method will enable us to explore the relationship between open banking and developing countries, as well as gauge the extent to which external or control factors influence open banking’s performance.

For our first hypothesis, positing that open banking has yielded positive outcomes in developed countries, our regression analysis formula is as follows:

OBt = β0 + β1(FL) + β2(R) + β3(TTP) + β4(FI) + β5(API) + β6(ED) + εt

In this equation, ‘OBt’ denotes our dependent variable, open banking during the period ‘t’. The independent variable is ‘developed countries’. In addition, we incorporate the following external or control variables: ‘FL’ for financial literacy, ‘R’ for regulation, ‘TTP’ for third-party providers, ‘FI’ for financial inclusion, ‘API’ for application programming, ‘ED’ for economic development, and finally, ‘εt’, signifying the error term in our model.

As for the second hypothesis, which anticipates a positive outcome for open banking in developing countries, the corresponding regression formula reads:

OBt = β0 + β1(FL) + β2(R) + β3(TTP) + β4(FI) + β5(API) + β6(ED) + εt

Here, ‘OBt’ remains the dependent variable, representing open banking during the period. The independent variable is ‘developing countries’, while the control variables ‘FL’ (financial literacy), ‘R’ (regulation), ‘TTP’ (third-party providers), ‘FI’ (financial inclusion), ‘API’ (application programming), ‘ED’ (economic development), and ‘εt’ (the error term) complete our model.

In our proposal, we have formulated hypotheses and provided regression formulae to substantiate our hypotheses. The subsequent section will propose specific chapters for the forthcoming research study.

- PROPOSED CHAPTERS

The subject study proposes that research can be presented in five chapters to test the research questions raised in our proposal, the list of chapters to be proposed are:

CHAPTER 1: INTRODUCTION

CHAPTER 2: LITERATURE REVIEW

CHAPTER 3: DATA & METHODOLOGY

CHAPTER 4: RESULTS & DISCUSSION

CHAPTER 5: CONCLUSION & POLICY IMPLICATIONS

5- RESEARCH TIMETABLE

The study proposes the following research timetable for the actual study which will be initiated during fall 2021/ 2022

September 2021 - Literature review

October 2021 - Literature Review

November 2022 - Data Collection

December 2021 - Getting Initial Results

January- February 2022 - Writing Chapters

March 2022 - Applying for the Thesis Defense

REFERENCES

Aitamurto, T., and Lewis, S. C. (2013). “Open innovation in digital journalism: Examining the impact of Open APIs at four news organizations.” New Media & Society 15 (2), 314-331

Funk, R. J., and Hirschman, D. (2014). “Derivatives and Deregulation Financial Innovation and the. Demise of Glass–Steagall.” Administrative Science Quarterly 59 (4), 669-704.

Gozman, Daniel; Hedman, Jonas; and Olsen, Kasper Sylvest, “OPEN BANKING: EMERGENT ROLES, RISKS & OPPORTUNITIES” (2018). Research Papers. 183. https://aisel.aisnet.org/ecis2018_rp/183

Jacobson T, et al. (2012) Arsenite interferes with protein folding and triggers the formation of protein aggregates in yeast. J Cell Sci 125(Pt 21):5073-83

Kellezi, D., Boegelund, C., Meng, W.: Towards secure Open Banking architecture: An evaluation with OWASP. In: International Conference on Network and System Security. pp. 185{198. Springer (2019).

Lackberg & Larson (2020), Open Banking Loyalty A qualitative study on customer loyalty in retail banking. Master’s degree project in marketing and consumption.

Markos Zachariadis and Pinar Ozcan (2017) “The API Economy and Digital Transformation in Financial Services: The Case of Open Banking”, SWIFT INSTITUTE WORKING PAPER NO. 2016-001.

Nicholls, C., 2019. Open banking and the rise of FinTech: Innovative Finance and Functional Regulation. Banking & Finance Law Review, 35(1), pp. 121-151.

.Rastogi, Sharma, Chetan (2020). Open Banking and Inclusive Growth in India at https://www.researchgate.net/publication/340849253