A Comprehensive Analysis of the Relationship between International Trade, Imports, Exports, and Economic Growth: A Study of China, India, and the United States (1990-2021)

` `Abstract

This study seeks to assess the impact of international trade on the economic growth of China, India, and the United States. Additionally, it investigates whether import-oriented or export-oriented policies can positively influence economic growth. The research employs a methodological approach based on regression analysis to examine the correlation between economic growth and trade. Three hypotheses are formulated in response to the problem statement and conceptual framework. The study encompasses four key factors: Gross Domestic Product (GDP), Trade Volume (TV), Imports (I), and Exports (X). It primarily focuses on the long-term relationship, spanning from 1990 to 2021. Given its cross-sectional nature, all data utilized are historical time series data sourced from World Bank indicators.

Keywords: Economic Growth, International Trade, Import-oriented, Export-oriented.

Background

The relationship between international trade and its benefits has been a subject of interest for philosophers and theorists over many centuries. Questions regarding why nations engage in trade, the advantages of trade, and the role of government in trade have been a recurring theme (Wu, 2007). As the global economic landscape has evolved, so too have the answers to these age-old questions. The evolution of international trade can be broadly categorized into two chronological sections: the pre-doctrinal theories period and the development of international trade theory (Dorobat, 2015).

In the first section, international development and economic growth were influenced by political views, with no systematic study of international trade conducted. The prevailing theory during this era was mercantilism, which posited that nations could not simultaneously pursue economic and political objectives, thus framing international trade as a zero-sum game. Mercantilism advocated for an export-oriented economy, prioritizing the well-being of one’s nation.

The second section marked the development of international trade theory as a reaction to the mercantilist perspective that dominated the 16th to 18th centuries. The British Classical School, led by Adam Smith (author of “The Wealth of Nations” in 1776), advocated for specialization in the production of goods that could be made at a lower cost and their subsequent trade with other nations having a comparative advantage in other goods. David Ricardo, another member of this school, enhanced these ideas by introducing the theory of comparative advantage, suggesting that nations should specialize in producing goods with a higher comparative advantage rather than an absolute advantage.

Throughout the 20th and 21st centuries, the classical view of trade evolved into the modern trade theory. This theory underlines the importance of trade among nations and introduces concepts such as economies of scale and predicting trade patterns. International trade is now recognized as a significant contributor to economic growth and a means to combat global poverty while enhancing productivity and innovation (World Bank, 2018). However, international trade can also have profound effects on income distribution and unemployment, leading to conflicts of interest and necessitating government policies (Krugman, Obstfeld, Melizt, 2018).

As more countries have embraced international trade, its potential impact and related issues have come under closer scrutiny. Consequently, this study aims to reestablish the connection between international trade and economic growth in modern economies, focusing on the United States, China, and India.

While modern trade theory differs significantly from mercantilism, it is still associated with export-led trade policies. Much of the existing research has concentrated on export-dependent trade. However, it is noteworthy that countries like the USA, South Korea, and India have faced criticism due to increased trade deficits while experiencing economic growth. This suggests that import-led trade policies can also positively influence economic growth. Additionally, the causal direction and scale of impact between export-led trade and economic growth remain subjects of ongoing debate (Bhagwati, Edwards, 1998). Consequently, this study examines the relationship between economic growth and international trade from the perspectives of an import-oriented country (USA) and an export-oriented country (China).

In summary, this study addresses the question of the relationship between international trade and economic growth and investigates the extent to which export-led and import-led trade policies affect economic growth.

Literature Review

The potential advantages of international trade have been the subject of extensive empirical investigation. In theory, a positive correlation exists between trade and economic growth (Chen. 2009), leading to a wealth of empirical research exploring this relationship. (Singh.2010) adopts a dual perspective, examining international trade and economic growth from both macroeconomic and microeconomic angles. The microeconomic evidence underscores a significant and positive association between trade and economic output, while the microeconomic perspective highlights productivity as a principal determinant of trade within an economy, rather than the reverse influence of trade on productivity. Furthermore, Singh’s work acknowledges the pivotal role played by the World Trade Organization and the General Agreement on Tariffs and Trade in promoting free trade, notwithstanding challenges such as protectionist policies. The issue of trade gains has been a subject of debate for centuries, with questions regarding the extent of trade and trade barriers persisting despite the WTO’s advocacy for trade openness.

Today, while many nations endorse trade openness, the question of how much trade openness is optimal remains elusive. (Ulaşan. 2012) offers a comprehensive review of trade openness and economic growth through cross-country empirical research. This study examines trade openness using various metrics, including direct trade policies and trade volume as a proportion of GDP. Ulaşan’s investigation highlights the complexities involved in measuring trade openness and concludes that, in the long run, there is no significant link between trade openness and economic growth.

In addition to the numerous studies on the impact of trade on economic growth in emerging and developed economies, there is empirical research that seeks to establish a connection between economic growth and international trade for developing countries. In an effort to demonstrate this linkage, (Caleb, Mazanai, and Netsai. 2014) conducted an extensive review focusing on the relationship between trade and growth in Zimbabwe. Their study reveals a long-term connection between economic growth and international trade, emphasizing the crucial importance of the stability of microeconomic factors in promoting trade and, consequently, economic growth. The study suggests that policies aimed at enhancing trade would exert a substantial impact on the economy, allowing businesses to leverage trade and investment opportunities. Moreover, it proposes that trade policies targeting competitiveness and export expansion have the potential to stimulate economic growth in Zimbabwe over the medium to long term. A similar endeavor conducted by (Azeez, Dada, and Aluko. 2014) in Nigeria also yields empirical evidence of a significantly positive link between international trade and economic growth, with a focus on the influence of both imports and exports.

Export-oriented trade policies are recognized for their potential to stimulate economic growth, as exports serve as a vital source of income for nations, driving resource allocation toward optimal levels (Feder, 1983). A successful export growth policy can trigger a positive multiplier effect, generating a substantial feedback loop in the economy (Caleb, Mazanai, and Netsai. 2014). (Feder.1983), a study examining the sources of growth in less developed countries from 1964 to 1973, demonstrates that not only can exports contribute to economic growth, but also an increase in exports can reallocate unproductive sectors to more productive export-oriented segments of the economy. Similarly, (Yao. 2006) investigates China’s export-oriented strategy, highlighting the pivotal roles played by the devaluation of the RMB and the introduction of foreign direct investment (FDI) in driving China’s remarkable economic growth. However, the study also underscores persisting challenges, including uneven regional development and environmental degradation.

While imports are often viewed as potential constraints on economic growth, they can play a pivotal role in stimulating growth by facilitating the transfer of technology from developed countries to developing economies (Awokuse. 2011). (Islam, Hye, and Shahbaz.2012) contend that a long-term connection exists between imports and growth, particularly for high-income countries. Similarly, (Ugur. 2008), in his investigation of imports and growth in Turkey, indicates that imports and growth exhibit a positive correlation, particularly for investment goods such as raw materials, as opposed to consumer goods.

METHODOLOGY

Economic growth is conventionally measured using the standard metric of Gross Domestic Product (GDP), as endorsed by reputable institutions such as the IMF and the World Bank. GDP, as a gauge of economic performance, encompasses various components, including consumption (C), investment (I), government spending (G), and net exports (X-M). Given that trade is intricately linked to economic performance, a substantial portion of empirical research has sought to unveil the correlation between economic growth and trade, drawing on historical data (Sheehey, 1992). The underlying rationale for this pursuit lies in the understanding that if trade significantly influences the measurement of economic performance within a given period, any alterations in trade patterns will have a direct impact on aggregate output, namely GDP.

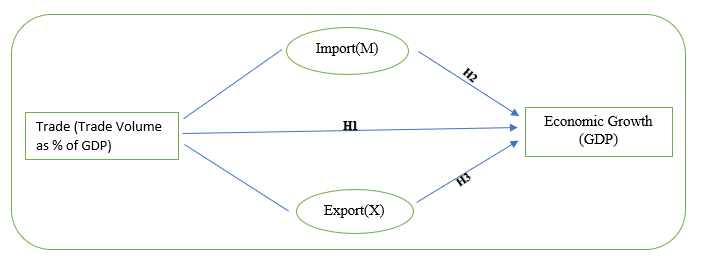

In alignment with previous research, this study adopts a methodological approach that centers on examining the correlation between economic growth and trade. Furthermore, this research extends the scope by delving into specific elements, assessing how both imports and exports distinctly affect economic growth. Based on the reviewed literature and the articulated problem statement, this study illustrates a conceptual model.

Figure 1. Conceptual Model of The Relationship between International Trade and Economic Growth

Grounded in the preceding literature, the defined problem statement, and the conceptual framework, this study introduces three hypotheses that seek to elucidate the linkages between international trade, imports, exports, and economic growth:

H1: There is a positive relationship between trade (Trade Volume) and economic growth (GDP).

H2: There is a positive relationship between Import(M) and economic growth (GDP).

H3: There is a positive relationship between Export(X) and economic growth (GDP).

Method

Participants

This study aims to investigate the influence of international trade, imports (M), and exports (X) on economic growth. The study focuses on countries as the targeted population, specifically India, China, and the United States. Data for this study is historical, and it takes the form of a cross-sectional study utilizing time series data. Past research has established a long-term behavioral correlation between a country’s trade openness and its subsequent economic growth (Awokuse, 2011). To accurately estimate this long-term relationship, the study examines a sample period spanning from 1990 to 2021, with a total of 372 observations collected.

Measures

The theory of trade lacks a definitive guideline for analyzing the link between trade and growth, often relying on empirical intuition and previous research (Awokuse, 2011). In line with this, the study formulates three hypotheses: the positive impact of trade on growth, the positive influence of both import-oriented and export-oriented policies on growth. Drawing from prior empirical research (e.g., Uğur, 2008; Ulaşan, 2012), the study employs a regression analysis method to explore the relationship between international trade, imports, exports, and growth.

Procedure

This study conducts a comprehensive analysis of the proposed hypotheses across three dimensions. The data utilized is secondary data collected from India, China, and the USA, including measurements of economic growth (GDP), trade volume, imports (M), and exports (X). All data is sourced from the World Bank Development indicators and is presented in US dollars (World Bank, 2022). To assess how trade affects growth, an understanding of how trade is measured is essential. As trade is a constituent of GDP, trade openness and volume directly influence a country’s output and, consequently, its growth. Thus, the study examines the total annual import and export as a ratio of GDP as a straightforward measure of trade volume (Yanikkaya, 2003).

The first dimension addresses the first hypothesis, which posits a positive relationship between trade volume and economic growth. Regression equations will be constructed, with the GDP of India, China, and the USA as the dependent variable, and trade volume as the independent variable. The results will be evaluated both separately and collectively. The second dimension, aligning with the second hypothesis, investigates the positive impact of imports on economic growth. The regression equation for this dimension uses the GDP of the three countries as the dependent variable and imports (M) as the independent variable. Since the goal is to determine whether increased imports positively impact the economy, data from all three countries will be analyzed individually and collectively. The third dimension examines the third hypothesis, which asserts a positive relationship between exports and economic growth. The corresponding regression equation will use the GDP of all three nations as the dependent variable, with aggregate exports (X) as the independent variable. Results from this hypothesis will be assessed both separately and collectively.

Analytical Plans

The statistical software package “EViews” will be employed to analyze the relationships between trade and growth, and whether import-oriented and export-oriented policies contribute to economic growth, based on the regression models. Additionally, the program will facilitate the comparison and analysis of the regression results for trade and growth in all three countries, both individually and collectively.

Ethical Considerations

This study will adhere to scientific research ethics and standards in accordance with the scientific integrity of the Near East University. The research will solely employ publicly available secondary data obtained from World Bank indicators, with no manipulation of the data to produce intended results.

Limitations of the Study

Economic growth results from the collective interplay of numerous factors, and while trade is a significant component of aggregate output, various other elements contribute to a country’s economic growth, including productivity, government spending, and investment. These additional factors explain the potential for conflicting results in the evaluation of trade and growth in previous research. Consequently, this study will exclusively focus on trade as the primary determinant of economic growth. To address these complexities, regression analysis will provide insights into the potential correlation between trade and economic growth. Moreover, a country’s economic condition varies over time, influencing the impact of trade on aggregate output. As a result, this study examines the specific period from 1990 to 2021 to account for these temporal variations.

Conclusion

The interplay between trade and economic growth has been the subject of centuries of inquiry and study. Numerous philosophers and scholars from around the world have offered diverse perspectives on the impact of trade on society, culminating in the development of modern trade theory. This theory predominantly supports a positive outcome of trade on economic growth. Consequently, many countries, including the World Bank, advocate for trade openness. Nevertheless, as the global economy becomes increasingly open to trade, it is evident that trade can also have detrimental effects on income distribution and unemployment. These adverse effects have faced significant criticism in recent years, particularly in Western countries, which rely on countries like China, the world’s largest exporter of goods, while simultaneously running trade deficits. This scenario presents multiple challenges, including assessing the contemporary relationship between trade and growth in the 21st century, discerning the benefits of imports, and evaluating the benefits of exports. As a result, this study seeks to assess the relationship between trade and growth by examining the three most populous countries globally—China, India, and the United States. Additionally, the study will investigate whether relying solely on imports or exports can positively impact economic growth.

References

Awokuse, T. O. (2011). Trade openness and economic growth: is growth export-led or import-led?. Applied economics, 40(2), 161-173.

Azeez, B. A., Dada, S. O., & Aluko, O. A. (2014). Effect of international trade on Nigerian economic growth: The 21st century experience. International Journal of Economics, Commerce and Management, 2(10), 1-8.

Caleb, G., Mazanai, M., & Dhoro, N. L. (2014). Relationship between international trade and economic growth: A cointegration analysis for Zimbabwe. Mediterranean Journal of Social Sciences, 5(20), 621.

Gershon Feder (1983). On exports and economic growth., 12(1-2), 0–73. doi:10.1016/0304-3878(83)90031-7

Chen, H. (2009). A literature review on the relationship between foreign trade and economic growth. International Journal of Economics and Finance, 1(1), 127-130.

Islam, F., Hye, Q. M. A., & Shahbaz, M. (2012). Import‐economic growth nexus: ARDL approach to cointegration. Journal of Chinese Economic and Foreign Trade Studies. Singh, T. (2010). Does international trade cause economic growth? A survey. The World Economy, 33(11), 1517-1564.

Shujie Yao (2006) On economic growth, FDI and exports in China, Applied Economics, 38:3, 339-351, DOI: 10.1080/00036840500368730

Sheehey, E. J. (1992). Exports and growth: additional evidence. The Journal of Development Studies, 28(4), 730-734.

Uğur, A. (2008). Import and economic growth in Turkey: Evidence from multivariate VAR analysis. Journal of economics and Business, 11(1-2), 54-75.

Ulasan, B. (2012). Openness to international trade and economic growth: a cross-country empirical investigation. Economics Discussion Paper, (2012-25).

Yanikkaya, H. (2003). Trade openness and economic growth: a cross-country empirical investigation. Journal of Development economics, 72(1), 57-89.